If you’re a woman working in the anti-fraud space, you’re well aware of how male dominated it can be. Even if you’re not in the space, the aforementioned statement should come as little to no surprise. I was discussing this back in 2007 with some other industry colleagues and we decided to set up the Fraud Women’s Network. The main premise being, to bring together women involved in all aspects of fraud prevention—detection, investigation and prosecution—to network and share best practices in order to tackle the threat from fraud and organised crime head on.

We were impressed by how quickly we grew our membership base. Now with more than 120 full-time members encompassing many years of fraud prevention expertise, we educate and mentor others and hold several events each year from breakfast briefings on fraud in the art world to the latest in dating fraud and how it’s being tackled by the police.

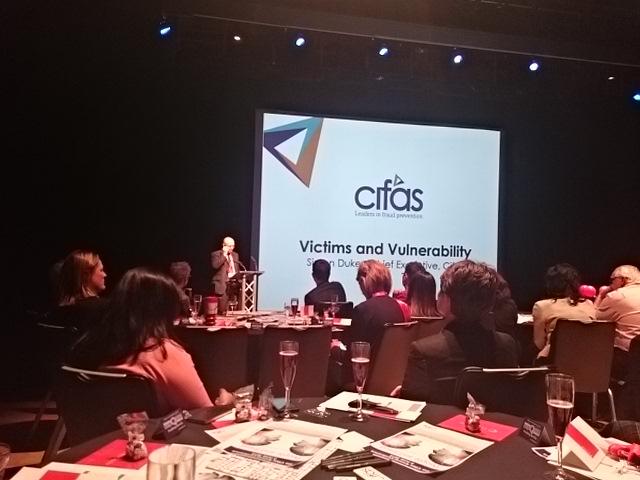

At our recent annual event, our theme was : Are you the weakest link? Victims and vulnerability in the modern age. We always spend a lot of time formulating our agendas and had two fantastic speakers from both Cifas and the FCA who gave their insights into the ever growing problems of fraud scams targeting both consumers and businesses in the UK. We attracted almost 100 delegates on the day, both male and female!

Simon Dukes from Cifas kicked off the evening session as he discussed how criminals have started doing their cost/effort analysis and found fraud to be a lucrative business. In 1992, 847 bank branches were raided, yet in 2013 only 89 had the same fate. Why? Banks are now less vulnerable. They have less cash held on site and CCTV now has much clearer images. Committing fraud online is much easier. You are much less likely to get caught and if you do, then the penalties are much lower than raiding your local HSBC.

With Cifas estimating that a fraud is committed every second in the UK, it’s getting harder to protect ourselves and there are more vulnerable groups emerging. Surprisingly the 21-30 year old age bracket is a growing group for fraud scams, partly as they live most of their lives online now. Education is going to be key, especially for those 7.1 million people in the UK who have never used the internet.

Mark Francis from the FCA covered Investment Fraud and the huge £1.2 billion lost a year through this scam. It can include ‘get rich quick’ schemes as well as shore fraud and unauthorised collective investment schemes.

Mark stated that consumer education has been working with the boiler room frauds but it’s within a fraudster’s nature to evolve and they will become ever more ingenious with their techniques. These scams are particularly effective on retired couples who have resources and confidence in managing their money. They can sadly lose very large sums of money to these relentless fraudsters.

As a not for profit organisation, we work closely with and rely upon not only the tireless contributions of our steering committee, but also our very generous sponsors. Without their support, we would be unable to offer these valuable sessions.